Portfolio value is driven by the quality of the projects in the pipeline. Like any process innovation is the same way garbage in garbage out. Making good portfolio decisions only helps to release the full value of the total project portfolio, but will not create value by itself.

So garbage in garbage out. How do we avoid garbage and find gold?

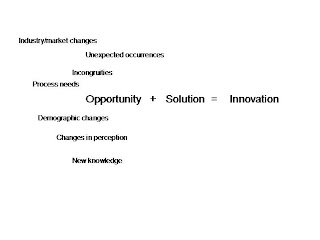

For a market pull driven innovation strategy I have always been a fan of the logic of segregating opportunities from solutions. Opportunities are something that the company wants to pursue, that satisfies a need of sorts, has a business case for the company etc...Opportunities then require a solution to fulfill the opportunity. Often companies spend most efforts in finding the perfect solution, although the value is in the opportunity.

Good opportunities have a great value proposition, fits strategy, are unique and have several great solutions. Take the ipod for example, the opportunity of digital portable music leveraged changes in the market place and demographics of music consumers, new knowledge and maybe changes in perception how music should be distributed and consumed. This specific opportunity had so many solutions that apple didn't have to develop any of them, they all pretty much existed. In addition, there was very little uniqueness in the solution and what they added the opportunity could afford it.

Opportunity is not worth the opportunity if the value and uniqueness is driven by the solution. I my view a good opportunity can demand a high price, and consequently has several solutions, because we can invest more in the solution. Additionally it is easy to find an unique solution to a good opportunity.

In my career what I have seen often is that we do not spend enough energy and effort in defining true opportunities. What happen is that most opportunities aren't unique, which consequently requires that the differentiation has to happen through the solution. Problem, however, lies in the fact that because the opportunity is not unique, people will not be willing to pay for it much more regardless the uniqueness of the solution. So R&D organizations spend most of their efforts trying to generate miracles, lower cost solutions that create a differentiated customer value propositions. This begs a question, why define the opportunities at all. In essence finding solutions for undifferentiated non-unique concepts is a technology push strategy and resembles innovation in commodities, where you can't get price regardless how you improve the product, driven by the fact that the opportunity the solution is trying to fulfill is a me too. In fact bad opportunity is looking for a miracle solution to make it a true opportunity. The hit rate in these is too low because it can't afford the unique solution. Consequently bad opportunities generate bad projects, that are very risky technology wise as well as market wise, has low NPV due to low margins, length of the project and modest sales projections. Execution is also hard because the organization sees no clear value proposition to the customer nor to the company.

Company's innovation portfolio value is driven by the quality of opportunities and not the solutions. Opportunities, on the other hand, are very closely related to the strategy the company wants to pursue, because strategy defines where we hunt for these opportunities... like how we grow and stretch our brands, who are our customers, what are we trying to sell to them, where and how etc. So, if you want to increase the portfolio value, change the opportunities. This means that you may need to change the hunting grounds and shift your strategy drastically.